The perilous path of perpetually plummeting prices….

ok ok – there is such a thing as tooooo much alliteration

The ebbs and flows in business are leading to higher high-water marks in service and lower low-water marks on price.

I ordered a journal on line two weeks ago and it took three weeks to come. (ok just checking you are concentrating) It DID take three weeks but I ordered it a while ago. Three weeks is aaaaages. WTF? I regularly order books from the UK and they generally come in under a week and other things I order in Australia usually come the next day. I am part of the problem. My expectations are very high now for delivery times. The high-water mark on service is next day, soon to be same day and then to be 1-2 hours if Amazon repeats its service levels from other international markets.

Consumers also expect lower prices.

Why?

Well the main reason is… they are getting them.

But what’s driving that?

Reason 1 – the world is putting on additional capacity

Imagine we run a factory making stegdiw’s, the new widgets. If we put on a second shift we can make more stegdiws per week, we spread our fixed costs over a higher number of stegdiw’s and thus, amidst constant bleating from parties who shall remain anonymous, we drop their price to our customers – why? because we can.

Our planet is putting on extra capacity right now, just like our factory. More people are coming online – connecting to each other online, learning online, marketing online, selling online, delivering digital information and products online. All this connection is bringing more labour to bear and its increasing the world’s capacity – our second shift has also added a third shift and we are 24/7. If, as many have, you find a way to do that with less assets, either other people’s assets or with digital assets, you have even lower fixed costs.

Reason 2 – Price transparency

Price transparency is here. There is not much buyers can’t find out about market prices. Where in the past there was variance, shadows and profitable pockets – we now have convergence, light and competition.

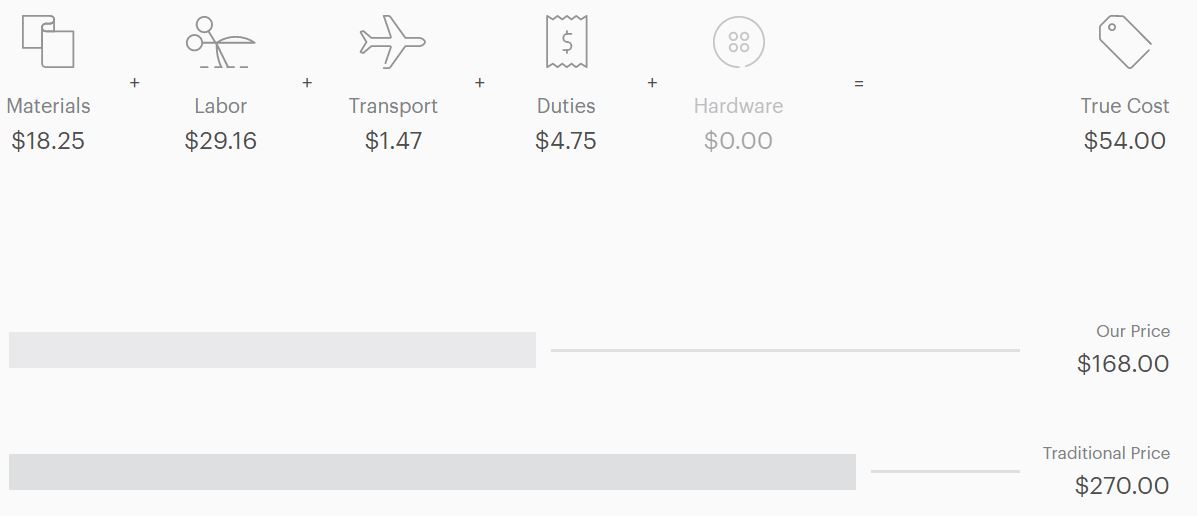

Reason 3 – Margin Transparency

Cost Transparency is coming. Everlane is a good example of this. Here is an excerpt from their website

————————————————————————————

Their mark ups on top of this cost are still significant – so far. The consumer will be able to decide what is an ‘acceptable’ margin for this type of retailer to make.

Reason 4 – More competition, as global players land here

Australia has more and more international players entering our retail markets. In food we are now accustomed to our German retailer – Aldi and our American retailer Costco. But now we have Kaufland landing in South Australia. Kaufland is owned by Lidl’s parent, German company Schwarz Group, one of the largest retailers in the world, and Aldi’s arch rival. H&M, Zara, Forever 21, Topshop and Debenhams are amongst a host of international fashion retailers that have had Australia on their expansion agenda. With varying degrees of success so far but not before increasing the fight for the consumer’s store-dollar!

If you’re not in retail , then you might be competing against offshore service providers (graphic design, websites, marketing automation etc) or you may have imported goods significantly undercutting your price points.

Reason 5 – disintermediation

This removal of intermediate parties or ‘middlemen’ between producers and consumers.

There are many examples where intermediate parties are disappearing or being squeezed by disruption.

One more radical example is Unilever and Mars have announced they will sell direct to consumers in the UK. Retail’s reinvention may be bigger than News Media’s makeover…..

Reason 6 – more and more and more and more marketplaces

One of the biggest business model trends is the rise of online Marketplaces. Places where buyers and sellers meet have been around for millennia but now they are easier to build, easier to service and easier to access. Marketplaces provide a more efficient market for business to be conducted, which means buyers and sellers determine the selling price and often compete away better margins. One of the pioneers was eBay but now we have countless versions

- sharing economy marketplaces like Airbnb, parkhound

- advisory marketplaces like iSelect

- service provider marketplaces like Fivrr, Upwork, Airtasker

- more traditional online listing marketplaces like carsales.com.au, realestate.com.au, booktopia and Seek.

With all these attacks on margins, how are some companies speeding up delivery and improving service?

The answer is business model innovation.

Business Model Innovation often creates disruption. Disruption changes the way a market operates. It is market innovation, not customer, product or process innovation. And market innovation changes the prevailing norms in a market like these changes below,

Where a customer buys

- We can buy groceries from home

How a customer buys

- Hello cars – Australia’s first online used-car dealership

Whose assets are used in the production or consumption process

- Marketplaces are renting out other people’s cars, homes, car parks, power tools, leisure craft

Where consumption occurs

- Many people’s banking experience is now in the home or office

Use of the ‘crowd’

- PWC’s open innovation platform to solve business and government problems

Whether the buyer/seller interaction is direct or indirect

- Get your home loan from a mortgage broker

- Consumers in the UK can now buy direct from the food manufacturer (Unilever, Mars etc)

Whether a good or service is paid for ‘per transaction’ or ‘for ongoing usage’

- GE sells aircraft engines or it sells uptime on those engines and retains ownership of them – ‘power by the hour’

Comments are closed.